HR & Payroll Services

Human Resource (H.R.) Services

Having problem in getting a HR & payroll administrator? Worry not and let us cover the HR & payroll for the time being as you are in process getting an in-house administrator.

1. Payroll Statutory Submissions

- a. From RM 500.00 per month;

- b. For 1 to 5 employees;

- c. Additional employee cost RM 100.00/ person;

2. Opening a Potongan Cukai Bulanan (PCB)

- a. RM 300.00 per company;

-

b. 20 minutes of training via Team-Viewer.

- Note*

3. Monthly Submission of Potongan Cukai Bulanan (PCB)

- a. Minimum RM 300.00 per month;

- b. For 1 to 3 employees;

-

c. Additional employee cost RM 50.00/ person.

Note* for Item 2:

i. PCB is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. Most people, however, are quite confused with the PCB and income tax filing and most payers are shocked to find out the amount of tax they would have to pay after all the calculation because they assume that PCB is the final tax. OCB is a system of tax recovery where employers make deductions from their employees’ salary or wages every month in accordance with the PCB deduction schedule. This is a standard requirement by LHDN, in that neither the employer nor employee has any choice in the matter.

EPF, SOCSO, EIS & HRDF

4. Application of EPF, SOCSO & EIS account

- a. RM 300.00 per company;

- b. Forms filling-in;

- c. 20 minutes demo via team- viewer;

- d. EPF Registration Form;

- e. SOCSO Registration Form;

- f. EPF, SOCSO & EIS Excel Sheet;

- g. Closing of EPF, SOCSO & EIS at RM 324.00 (inclusive of SST).

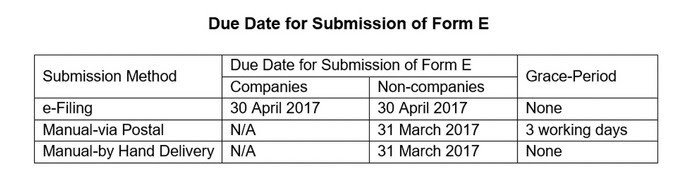

5. Filling of Form E

- a. RM 150.00 per filing;

- b. RM 10.00 addition per employee filing;

-

c. Download form sample here.

Note*

6. EA form for the employees

- a. RM 50.00 per head;

-

b. Information required: Salary for annum, allowance, bonus, total deduction for KWSP & SOCSO & any benefits in kind.

-

Note*

7. Drafting Services

- a. Employment Letters (Probation & Confirmation) @ RM 300.00 per set;

- b. HR Company handbook from RM 1,000.00 depending complexity ;

- c. Customized Draft Services @ RM 150.00 per page.

8. Registration of HRDF

-

a. Registration of HRDF @ RM 300.00

- b. HRDF Standard Requirements.pdf

9. Employment Contract @ LHDN Stamp Duty (SD)

- a. Submission of Employment Contract Stamp Duty @ RM 100.00/ per SD Certificate and subsequent RM 50.00/ per SD Certificate.

Note* for Item 5:

i. Form E is a declaration report to inform LHDN on the number of employees and list of employee’s income detail for the year.

ii. Form E Sample in PDF Version: Form E Sample and for those who are doing on ownself, pls download the guidelines:

https://ez.hasil.gov.my/ci/Panduan/PanduanCI_PermohonanNoPIN_e%20V1.2.pdf

iii. For manual submission for non-companies and if you have not received any Form E, you may download it at: www.hasil.gov.my > Borang > Muat Turun > Borang / Info > Majikan > 2019

iv. EA Form Sample in PDF Version: EA Form Sample

Please take note that,

- Form EA – Must prepare and provide to all employees by 28 February of the subsequent year.

Note* for Item 6:

What does EA Form means:

i. A Yearly Remuneration Statement (EA/EC Form) that includes all the income received by the individuals from the company like salary, commission, incentive, allowance & etc. for the past year.

ii. Refer to Section 83(1A), Income Tax Act 1967, with effect from year of assessment 2009, every employer shall, for each year, prepare and render to his employee statement of remuneration of that employee on or before the last day of February of the next immediate year.

iii. To generate EA form for the employees @ RM 50.00 per head. (Infomation required: Salary for annum, allowance, bonus, total deduction for KWSP & SOCSO & any benefits in kind)

iv. Forms to be used:

- “EA” – Remuneration Statement for Private Employees.

- “EC” – Remuneration Statement for Government Employees.

Forms and Resources

Payroll & PCB

Have a quick look on the payroll guide on the different types of contribution:

EPF Registration

Have a quick look on the payroll guide on the different types of contribution:

SOCSO and EIS Registration

Have a quick look on the payroll guide on the different types of contribution:

Remarks:

i. Respective forms;

ii. A set of Incorp docs for respective departments;

iii. Company Chop;

iv. Representative letter if non director to attend the respective departments;

v. Anything else? Just whatsapp our specialists team who are ready to assist you.

Checkout this article for more details

Remuneration that subject to Employees Provident Fund (EPF), SOCSO, EIS & HRDF

ACT 452 1. EMPLOYEES PROVIDENT FUND ACT 1991 a. If you are wonder can a owner to contribute EPF and