Company Incorporation (LLP)

We provide incorporation of Limited Liability Partnership.

We provide incorporation of Limited Liability Partnership (LLP) in Malaysia at only RM 2,000.00 inclusive of SST and it could be done within 3 to 4 working days but beforehand please get prepared on this required info as below:

Limited Liability Partnersip (LLP) incorp checklist:

HC Incorp Standard Client Due Diligence (CDD) Individual, Company & ROS.pdf 15022024

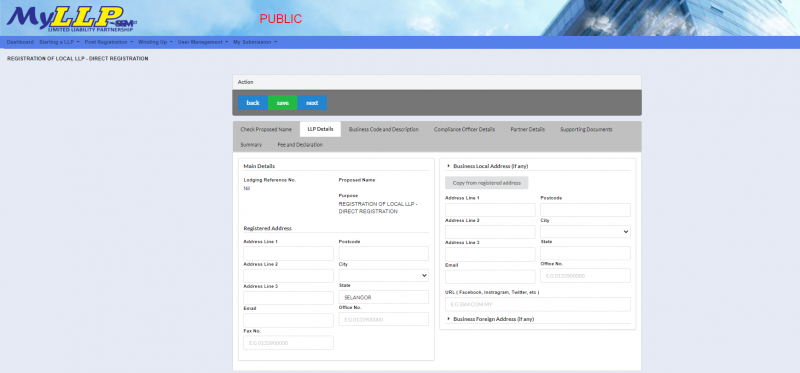

1. Work Steps to incorp a LLP:

- You may propose to me the company name that you need: 1st choice and 2nd choice SSM Guidelines on Company Names 06122022.pdf;

- Directors’ HC Incorp Standard Client Due Diligence (CDD) Individual, Company & ROS.pdf 15022024 Identification Card (front and back);

- Directors’ & email address and contact;

- Appointment of Compliance Officer;

- Company’s activities;

- Company ‘s business address if any;

- Directors shareholding and finalizing of the basic of LLP Shareholders Agreement with LHDN Stamp Duty Paid;

- Incorporation Fees of RM 2,000.00;

- Submission to SSM;

- Awaiting approval in 3 working days.

2. What we include in LLP’s incorporating package?

- Incorporating a LLP;

LLP Compliance Reading 30012021.pdf - Registration of LHDN’s Tax File;

- LLP Basic Partnership Agreement with LHDN Stamp Duty Paid;

- Stamp Duty of RM 10.00 per agreement;

- Company Chop;

- LLP’s compliance & Compliance Officer checklist;

- LLP’s Certificate;

- Opening of bank UOB current accounts;

- HC Tax Submission Task List.form

3. Primary Features of LLP:

- The LLP is a body corporate and has the legal personality separate from the partners (separate legal entity) SSM Akta PLT (APLT) 2012.pdf;

- LLP is a perpetual succession;

- Any partnership in the partnership will not affect the existence, right or liberty of the LLP;

- LLP has unlimited capability and is capable of suing and be sued for it, acquire, owning, holding and develop or dispose of property;

- LLP may do and suffer such other acts and things as bodies corporate may lawfully do and suffer.

4. Registration of LLP:

- By minimum two (2) persons (in whole or in part, an individual or a body corporate either Malaysian or Non Malaysian but Compliance Officer must be a Malaysian);

- For any lawful business for the purpose of making a profit; and

- In accordance with the terms of the LLP agreement;

- LLP Registration Guideline : LHDN LLP Tax & Requirements.

5. Who can register?

- Professionals;

- Small and medium business;

- Joint Venture;

- Venture Capital (Venture Capital).

6. Compliance Officer (CO)

- Registration of LLP is made by the Compliance Officer appointed by LLP;

- One of his partners or a person qualified to act as Compliance Officer under the LLP Act 2012 ;

- At least 18 years old and Malaysian citizen/permanent resident; and

- Residing in Malaysia;

- Ensuring all compliance been updated, tax submission and Annual Declaration (RM 300.00) to SSM;

- Compliance Officer can appoint and delegate the compliance works to HC upon agreed by the Directors.

7. LLP’s registered office function

- Accounting records;

- Annual Declaration;

- Notice of Registration;

- Lodged documents with the Registrar;

- The LLP partners agreement;

- Instruments charge to LLP.

8. Perkongsian Liabiliti Terhad PLT (LLP)’s BUMIPUTERA Status Application:

The documents needed:

- LLP’s registration certificate;

- Latest 1 month bank statement;

- Owner’s I.C. (Bumiputera);

- Latest EPF statement with proof of payment;

- LHDN’s stamp duty paid tenancy agreement.

Remark:

a. For Compliance Officer in assuring compliance’s further reading:

Limited Liability Partnership (LLP) Package

Cost : *RM2,000.00*

- Required 3 - 4 working days

- Upon completion of all required documents

*Price inclusive of SST

[fullstripe_form name="incorporate_llc" type="popup_payment"]