Date: 18th May 2021

1. The following questions were frequently asked by our foreign clients who tends to invest in Malaysia by incorporating a new company in Malaysia.

Question 1: I’m holding a foreign passport and can I incorporate my business here?

Question 2: For now, I must have 2 directors to incorporate the company and will it be the Malaysians?

Question 3: Rumours has it: I must give my 30% shares to a Malaysian!

Question 4: I can’t be the director of I’m not holding the visa or permit?scary of DOUBT in having business!

2. Before we move on let’s go back to basic in incorporating a company in Malaysia:

a. At least 1 director with residential addresses in Malaysia (if Malaysians then we will refer to IC or if foreigners with Malaysian residential, then support with LHDN stamped duty paid tenancy agreement);

b. The age of the directors must be at least 18 years old;

c. To appoint a Company Secretary within 1 month upon incorporating the company;

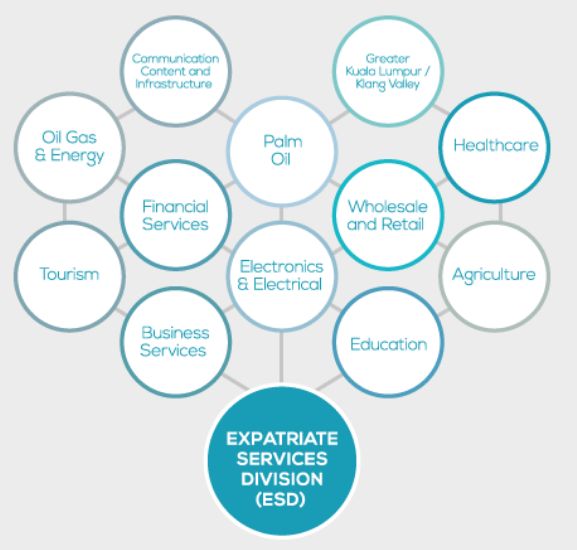

d. Foreigners do not need Malaysian partners except certain industry and for now, Malaysia welcomes expatriate for this industries:

Foreigners don’t need to give our shares to any person.

The rest are commonly like company name, business activities, IC or passport and total paid up. After all, Malaysia is a business friendly country and it’s governed by the Company Act, 2016.

Thank you for investing your business in Malaysia.

Thank you for investing your business in Malaysia.

3. Foreigners are welcome to invest in Malaysia and they are allow to apply for work permit through 4 categories:

Type 1: Setting a Malaysia International Company at Labuan with the corporate tax on net profit at 3% and eligible to apply 3 positions of foreign workers under this set up. However, there are terms and condition apply.

Type 2: Incorporating a company and apply a 2 years DP 10 permit under the company. This method comes with 2 options:

a. A foreigner is allow to incorporate a 100% owned company in Malaysia and to apply a 2 years Malaysia work permit (DP 10) but however do check with us ahead on what is allow and what is not. Further on this for shareholder/ directors to apply DP 10, the company will need to have RM 500,000.00 as paid and if application from Whole, Retail Trade License (WRT), you have to make sure that the business is unique and basically, you will need to fulfill a checklist.

b. Joint-venture with a Malaysian in incorporating a Sdn. Bhd. (Private Limited) where the foreigner is allow to apply a 2 year DP 10 with the company paid up of RM 350,000.00 where this company is no longer to apply WRT if the Malaysian director is having more than 50% shares. Be inform that the process will be strict as new company is without any history but if you got governmental support, then will be exceptional.

Type 3: Foreigners under a Malaysian company where the employers can apply DP 10 for the foreigners as the they are under employment where the salary have to be in between RM 5,000.00 to RM 10,000.00; among the positions: Specialists or technical positions with a degree as a basic requirement.

Type 4: Investing a Regional/ Representative office (RO) in Malaysia as the foreigner is having is own office in his home land with a minimum of 2 years of operation however the RO is only for facts finding, surveying or sourcing. RO investors or with family through this type can enjoy a 2 to 5 years of work permit.

Happy investing and applying.